Exchanges have existed as far back as the 1300s in the Middle East wherein merchants and traders would meet to trade commodities. By the early 1600s, the Dutch East India Company became the first company to be commoditized, securitized, and exchanged. Alas, the modern stock exchange was born!

The idea was simple. Global investors and traders would be able to congregate under the exchange and create value for companies; this made it replicable across the globe. Eventually, stock exchanges started sprouting by the 1700s in different cities, with the notable ones being in Paris in 1724, Philadelphia in 1790, and New York in 1792. Of course, the Philippines had its very own exchange established in the 1900s–the first in Southeast Asia and one of the oldest in Asia.

Our story begins.

Manila. (MSE)

At the heart of the Orient, five foreign enterprising entrepreneurs sought to establish the country as a business hub to advance the economy in August 1927. This led to the country’s firstborn exchange, dubbed the Manila Stock Exchange (MSE), located at the Insular Life Building in Binondo, Manila.

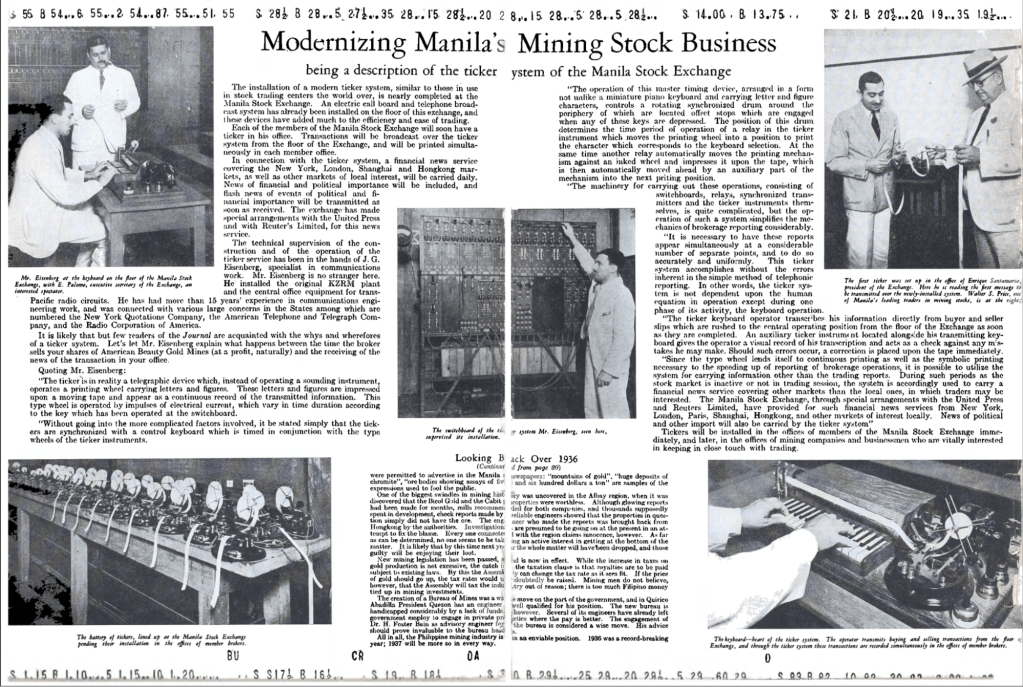

In the 1930s, the exchange saw about 30 listings from the banking, insurance, agricultural, industrial, and mining industries with its performance tracked under the Manila Stock Exchange Average. At the time, the mining industry was the most bullish and speculative given multiple initial public offerings of companies. Mining was established by the Spanish colonizers with the enactment of the Spanish Mining Law of 1867. It was only until the turnover of the Spanish to the American colonizers did mining became more formalized. This became more evident with the passing of the Philippine Bill of 1902 requiring all minerals, ores, and other precious metals found in the country to be the property of the United States of America. The law saw the establishment of popular names that may be familiar which include the Benguet Consolidated Mining Company, Itogon Mining Company, and Balatoc Mining Company.

When the Great Depression occurred in the United States in 1929 and the subsequent abandonment of the gold standard in 1933, the American government began acquiring gold abroad which drove global prices higher. Mining moguls hit the goldmine as higher gold prices drove foreign and local businessmen to invest in Philippine mining; the 1930s saw the Philippines become the second top gold producer in the world.

Modernizing Manila’s Mining Stock Business (American Chamber of Commerce, 1937)

As the exchange boomed from the mining industry, a financial bubble started forming. Firms started over-issuing capital stock causing excessive dilutions and dampening company fundamentals. Alongside this was the lack of a corporate governance framework, leading to fraud and embezzlement. In response, the government enacted the Securities Act of 1936, which effectively created the Securities and Exchange Commission to protect investors, traders, and dealers. In addition, MSE started developing trading rules consistent with international standards. Some rules established penalties, necessary committees, and ownership consistent with the Blue Sky Laws in the United States.

A Snapshot of Active Mining Companies in the Philippines (American Chamber of Commerce, 1937)

By the 1940s, World War 2 hampered financial progress for the nation as MSE’s operations were halted, causing illiquidity. By September 1945, 14 companies remained listed in the MSE with blue chips remaining. By 1946, the exchange restarted operations, moving to the National City Bank Building. Upon the resumption of trading, the SEC allowed all companies listed before the war to re-list assuming they could conduct the share transfer. Normalcy of the exchange saw business as usual with the mining industry back on top and remaining there for the next five decades.

Makati. (MkSE)

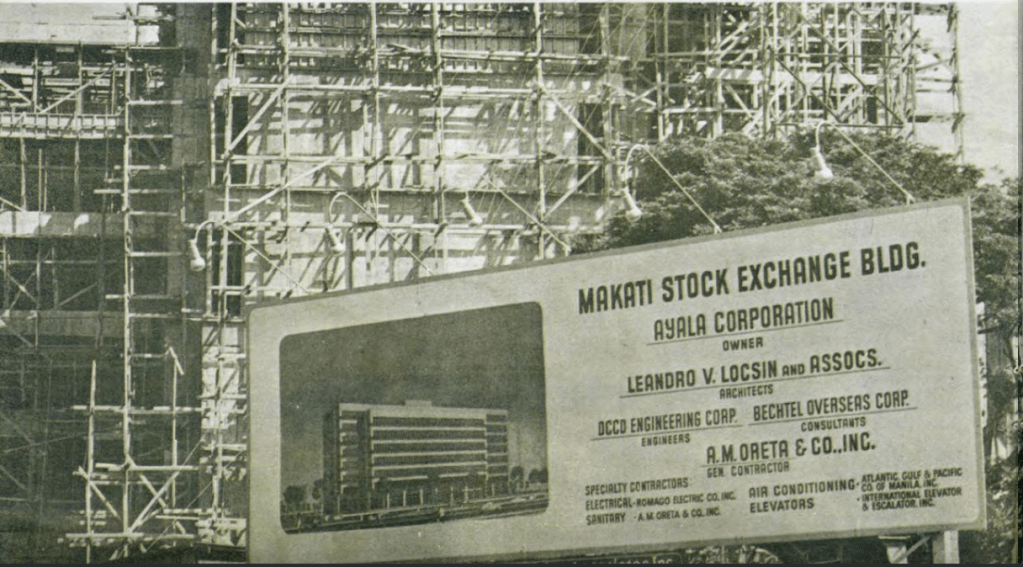

Kilometers away from the old exchange, a city was showing promise, thanks to the Ayala family. Makati City saw the comforts of modernization and in addition, favorable tax rates. As more citizens and companies flocked to the city, an economic boom was imminent. To further set the tone, the Red Scare of the 60s caused dysphoria amongst the American and Soviet factions as the possibility of nuclear warfare became a threat. The Philippines saw itself at a crossroads again as it was seen as the most politically stable in the Asian region, making it conducive to conducting business.

The Building of the Makati Stock Exchange (Ayala Corporation, 1970)

To cement Makati as the go-to financial hub of the developing nation, five Filipino maven magnates sought to compete with the old exchange in May 1963. A parallel with the former exchange, the Makati Stock Exchange also had its primary operations in the Insular Life Building albeit in Makati.

Brokers on the Exchange (The Republic, 1973)

As the MkSE saw a boom, it soon eclipsed its rival older sibling as more businesses went toward it. Oddly enough, of the 18 companies listed on this exchange, 16 of them were already listed on the MSE, exemplifying a “dual-listing”. Given the dual listings, stock prices would differ between both exchanges and became a cause of concern for potential investors as this violated asset-pricing theories and an indication of market inefficiencies.

By 1973, then President and Dictator Ferdinand Marcos passed two presidential decrees (PD) in the hopes of streamlining exchange operations. PD 167 sought to require companies to automatically list on both exchanges; PD 282 on the other hand allowed members between both stock exchanges to cross-trade with each other only for customer transactions. Essentially, the law looked promising from an operational standpoint because it was believed to have forced a singular price for any stock. However, this led to the polar opposite as these exchanges were competing entities yet had the same offerings, and the price difference between exchanges was still prevalent.

The 1980s to 1990s saw the rapid decline of the local markets as contemporary exchanges – such as Hong Kong, South Korea, and Japan – took off as these tiger economies saw massive levels of growth. A deep recession, few economic development policies, and higher levels of corruption saw foreign direct investments leave the Philippines, eventually challenging businesses to source capital.

Merger. (PSE)

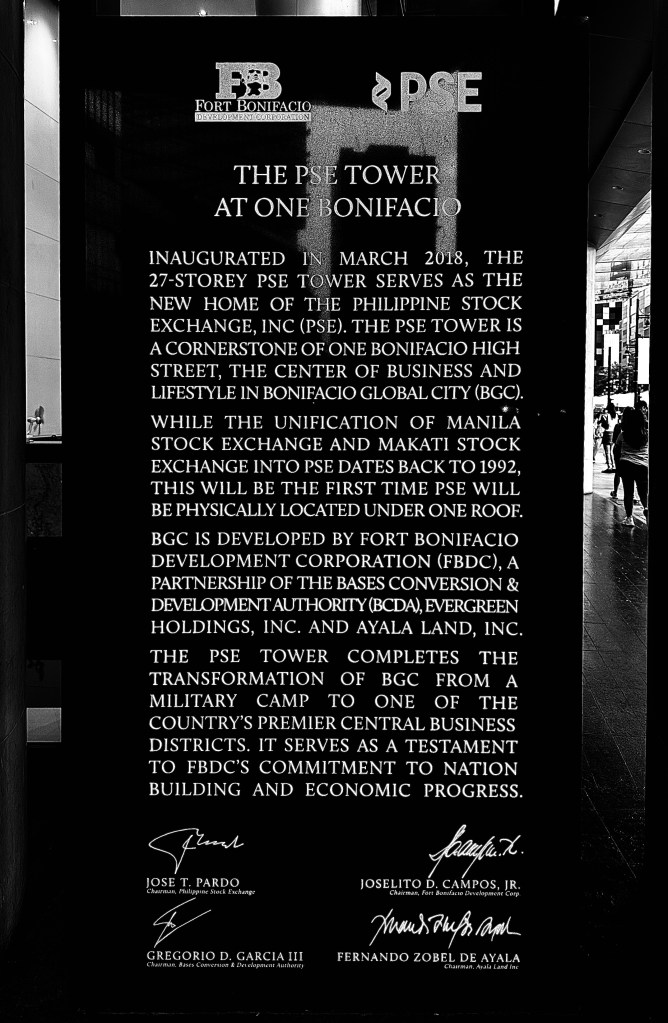

A rebirth of the exchanges was needed to keep up with the economies and much-needed liquidity was the main priority. In July 1992, President Fidel Ramos decreed the unification of the two exchanges under the name of the Philippine Stock Exchange (PSE); the merger was intended to standardize and achieve operating efficiencies.

By 1994, both exchanges saw the revoking of their members’ trading licenses, requiring them to attain membership under the new entity. In addition, major revisions were being made to the methodology for calculating the main index, the PSE Composite Index (PCOMP).

The Merger of Exchanges (Business Inquirer, 2022)

Global themes also played a part in the development of the exchange as they saw an overhaul in corporate governance with demutualization; this is where an exchange becomes a stockholder-controlled corporation, allowing it to raise capital by conducting an initial public offering. This motivated the exchange to seek revenues through listing, maintenance, membership, data feed, and service fees. The move was necessary to facilitate investor participation in the markets and to further advance the exchange.

The economy of the Philippines underwent liberalization to attract foreign investors and promote competition. This led to restructuring in different industries, particularly the telecom sector. The Philippine Long Distance Telephone Company (PLDT), which used to hold a monopoly, had to comply with competition laws as an illustration. Fresh capital from foreign investments soon came in as it reformed existing laws, created jobs, and reduced poverty.

The story of the Philippine Stock Exchange, like any other story, was not all sunshine and rainbows. As the Philippines continued to reap the benefits of global trade, there were tradeoffs as it exposed the local markets to global risks, leading to contagions such as the severe economic and social impacts from the Asian Financial Crisis of 1997, the US Tech bubble of 2001, and the Global Financial Crisis of 2007. It was only in the 2010s did the exchange truly saw an upward shift in its performance with the Corporate Governance code being implemented, translating to stability and transparency which priced assets at a premium. This may also explain why the period saw the highest level of foreign investment in the exchange. This period saw a growth of 413% which is currently the highest rate to date and is conclusive proof of the importance of strong economic fundamentals, strong governance, and political stability to investor confidence.

New PSE Headquarters (Raphael Canillas, 2023)

Today, it seems that the PSE would need to undergo more reforms to remain competitive relative to its contemporaries. If done effectively, the perception of PSE (and maybe risk) would allow for the hastened development of the Philippines and ultimately, raise the quality of life for the Filipino people.

Me.

Writing this article was a significant challenge due to the scarcity of digital details from the 1900s, especially since it is a niche topic. Local resources and archives only had the print version, while foreign sources had the resources available online. This is a call for our country to take immediate and diligent measures to preserve our financial history.

The Plaque (Raphael Canillas, 2023)

It is imperative that we learn from past mistakes and build on past successes to ensure true economic progress and continually improve the lives of Filipinos. As professionals in the finance and investment fields, we must step up and participate more in this critical aspect of our nation-building. Let us all strive to be financiers who prioritize integrity and strict compliance with ethics and professional standards.