Every currency has its story. It has played a vital role in the development of dynasties and the enrichment of empires. The value of money is crucial for its sustainability and functionality and is linked to precious metals or another currency. Even the Roman Empire, which acquired precious metals through the conquest of Western Europe, relied on a valuable currency to thrive for a millennium.

A currency’s value, alongside its intricate design, holds a tale of harmony and weaving together a rich mosaic of stories that reflect the unique journey that has shaped it over time. The Philippine Peso (PHP) is no exception from its history from the precolonial era to the present day.

At the beginning of the American colonization, the PHP saw a financial reformation with the introduction of the Philippine Coinage Act. A landmark law at the time that saw the Island nation jumpstart its development and solidify its name as the Pearl of the Orient. Follow the journey of the first modern currency reform between 1903 to 1905 and see its lasting impact.

The Changing Tides.

In the 1800s, empires rose and fell as they scrambled to adapt to the changing tides, with the forefront of this being the evolution of the global currency system. The Silver Standard had been the most common currency system but faltered as the price of silver was volatile, leading to hyperinflation, unemployment, and economic instability. Empires needed a new system which they found in gold, hence the Gold Standard. The transition spread like wildfire as empires began trading for gold and caused its price to go higher.

Not all followed though as Spain opted to stay in the old system. Spain had its gold but could not easily transition as its stock diminished because of the 1880s European Financial Crisis and the Spanish Government taking loans to fund their war against the Philippine Revolution. Since the Philippine currency was entangled with the value of its colonizers, its worth continued to decrease and face the issues of the Silver Standard.

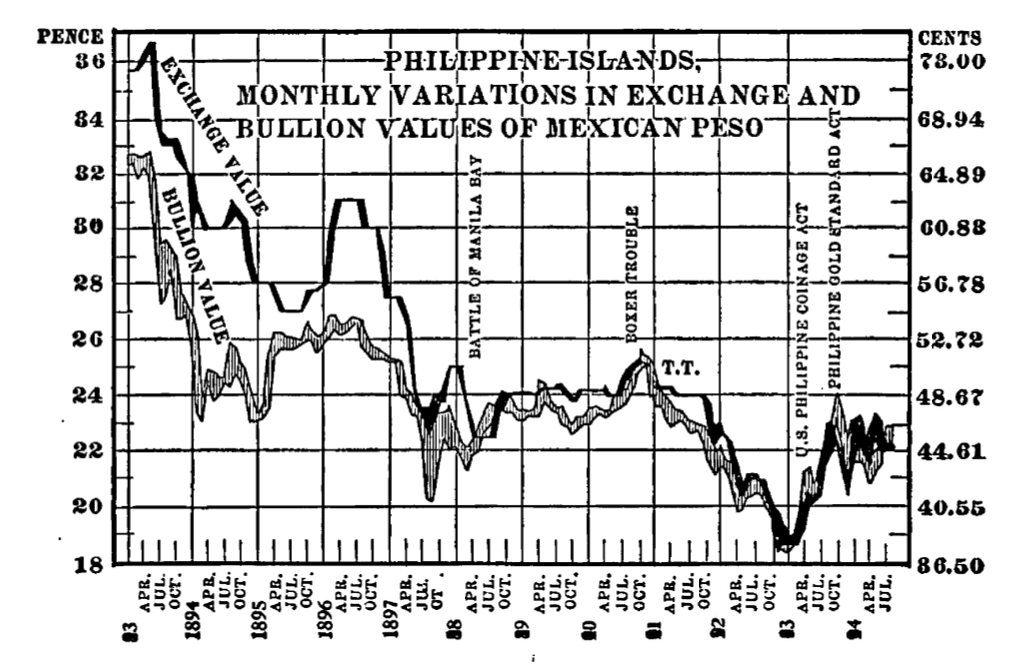

Philippine Currency at the FX (Kemmerer, 1916)

In 1898, the American colonizers bought the Philippines from the Spaniards. The local populace was facing a monetary crisis and had resorted to using five currencies, which included the Mexican silver peso (Mex), Alfonsino peso, Spanish-American peso, local banknotes, and various foreign coins. Plundering became common, as insurgents would take goods to survive or resell. Government services such as the Philippine Constabulary had been rendered ineffective as the salaries they received were next to nothing. Smuggling and counterfeiting were even an issue. The former colonizers did little to halt the entry and circulation of such coins. After witnessing such chaos, Jacob Schurman, the head of the First Philippine Commission, wrote to US President William McKinley that the state of the monetary system doomed their then-new colony to the crisis it was facing.

First Philippine Commission (University of Michigan, 1899)

The Money Doctors.

The situation was devolving into mayhem and would not be conducive to building a nation in its image. Harmonizing the Philippine currency system with its new master was a top priority, but there were still challenges. First, the amount of former currencies in circulation was unknown, and estimates varied widely. Second, counterfeiting and smuggling remained a significant problem. They figured that the cheapest and most efficient remedy was to buy out the silver-based currencies at a fixed rate in exchange for the US dollar. The Americans would even implement careful watch to ensure no other counterfeit or smuggled coin would circulate.

Despite the plan being well-crafted, uncertainty in the global financial markets lurked. One major cause was the Boxer Rebellion of 1899 which saw an uprising against western foreigners in China, including the Americans. The Western Alliance required significant amounts of silver for military expenditure causing its price to skyrocket. America could not keep keep up as it became too expensive exposing their new colony to even more risk. It was decided that they would have to halt all exchanges for the US dollar.

Charles Conant on a 1918 One Peso Banknote (Numista, 2023)

Difficult decisions had to be made, so the Americans had to bring in help from renowned financiers and economists, known as the Money Doctors. Charles Conant, an illustrious New York banker, would be one of the most successful doctors. His prescription to expel the ailing currency was to follow the Gold Standard with new Filipino-American money by passing two laws: the Philippine Coinage Act of 1903 and the Philippine Gold Standard Act. The medicine would work by introducing a theoretical gold peso worth half the value of the US dollar. A Gold Standard Fund was initiated to preserve the parity of the new coin. A new silver peso would then be the physical representation of that gold coin. Paper money, known as Silver Certificates, would also be introduced and backed by a Silver Certificate Reserve to match and stabilize the value. These silver monies would act like tokens as their value was higher than what was implied by their silver content. Meanwhile, the former currencies would have to be converted for new ones based on a set rate by the Treasury.

The Newfound Harmon(e)y

Although the law seemed straightforward, businesses and banks still had a preference to retain the old system. Despite agreeing that the Fil-Am currency would remedy the situation, there were concerns about the conversion as they believed that an instant transition would raise prices to accommodate the higher gold price. The only way for them to accept the Gold Standard was to have the conversion of the former currency be equal (at par) to avoid loss. Previous issues still plagued the nation, and the recent volatility of silver prices made the Americans wary about the condition the Filipinos set. If they were to convert at par, it would have placed a risk on the stability of the new coin. The only way to advance was to set the conversion below par to make it cumbersome to serve.

Market Scene and Beggars (University of Michigan, 1902)

The Americans set in motion their plan with the help of the private banking sector. They selected three banks to assist: El Banco Español Filipino (now Bank of the Philippine Islands), Hong Kong Shanghai Banking Corp. (now HSBC), and Chartered Bank of India, Australia, and China (now Standard Chartered). All the collected money from them would be sold to various nations.

Two laws were also enacted: one imposing heavy taxation on new financial contracts and instruments using the old currency, and the other banning its importation and implementing border patrol. Announcements were prepared, in twenty-one different local languages and dialects, telling the nation that ample time would be given. Bandillos, known as town criers, were even placed in the center of the faraway towns to address concerns.

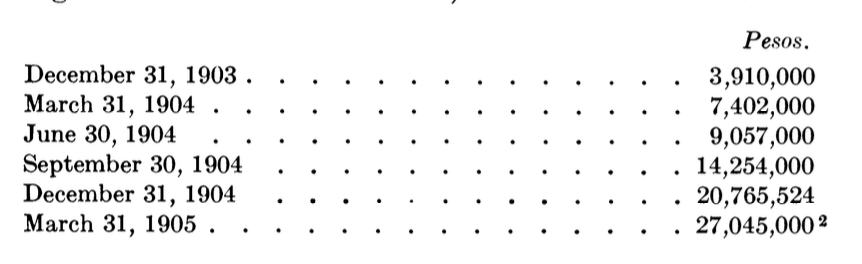

A Report on the Circulation of New Currency (Edwin Kemmerer, 1905)

By the first half of 1905, America’s vision had been fulfilled. Official reports from the Treasury offices found that 26M pesos of the former currency had been removed from circulation. The entire system was on the Gold Standard and established within two years without serious impairment to the state of the nation’s commerce. With a stable currency, prices of goods had been stabilized, cities were connected by new roads, and government services were restored. The local populace was now relatively in a better situation. Plundering had also been minimized as the Philippine Constabulary was finally paid adequately from the tax revenue collected by the Americans.

The story of reform does not end here. More financial events would unfold in the years to come, but the foundation laid would solidify the Philippines’ place in the world economy.

Me.

It was a rainy lunchtime when I took notice of a 100 peso bill that I received as change. Unfurling the note made me remember the mosaic theory from my CFA studies. The theory dictates that the value of a security is based on the gathered information an analyst receives. A lightbulb flickered on in my head and thought to unravel the stories of the nation’s currency and thus my research began. The article would be the first in my series trailing the stories of our beloved PHP.