A significant milestone in Philippine decolonization was when the Americans relinquished control to the Philippine government in 1946. This marked an important step towards the self-determination of the great nation. However, after centuries of colonization, the Philippines had much to learn and unlearn. Part of their major challenge then was to develop a functioning economy with their newfound independence.

True economic progress, which has a major impact on social progress, demanded the modernization of the financial institutions. At the core would be the establishment of the Central Bank of the Philippines – an institution designed to drive independent monetary policy and align the ambitions of a sovereign and self-governing nation.

The Currency.

The transitory period towards American colonization saw the nation shift towards the Gold Standard as recommended by renowned financiers, known as the Money Doctors. This would link the colonized economy to that of its master at a rate of two Philippine pesos to one United States dollar. There were flaws to the Standard, the most significant being that it was restrictive in borrowing and spending for expansionary fiscal policy. America and its colonies could only have as much money based on the amount of gold available in reserve.

Treasury Building of the Philippines (Neely, 1900)

By 1934, a new shift occurred with the system switching to a dollar exchange standard. This meant that the parity between the two currencies would remain the same however its value would be reliant on the state of the American economy. The Philippine monetary system under this regime would import America’s yield curves, inflationary environments, and economic cycles leaving the nation powerless to counteract its adverse effect.

The System.

American capital was injected into the banking system further symbolizing its grip on the nation’s territory and capital. The banking system was purely foreign at the start of American reign with only four banks remaining – none Filipino-owned. As counterparties, foreign banks created a far more decisive influence on the banking business devoting themselves to commercial interests rather than developmental policies.

Spanish Filipino Bank (Photo Supply Company, 2016)

This foreign exchange (FX) system became a fixed-peg parity system, which allowed the banking system to profit off the highly profitable FX business at low risk – hence the more business-friendly climate for such banks.

However, the monetary system was designed only to favor external stability rather than internal stability—mostly because of the fixed-peg FX system. The Treasurer of the Philippines solely maintained this system but had a passive role. Andres Castillo, one of the forefathers of the founding of the Central Bank of the Philippines, noted that the role was merely a glorified bank teller and bookkeeper.

Commercial District in Manila (The American Historical Association, 1945)

The Treasurer needed more power or initiative to reduce or expand the currency’s circulation. Regardless, the system could not allow for the economy to expand during prosperity nor to contract during depressions. As far as the Philippines was concerned, its production, employment, and capacity were still leashed by the Americans.

This anomaly would be rectified only by the creation of the Central Bank.

The Silent Lawyer.

Cuaderno taking his oath as the Finance Secretary (Takagi, 2016)

Miguel P. Cuaderno, noted to be a silent lawyer, led the charge for a freer economy. He said that the adoption of a currency system that would break away from its colonizer would allow the nation to be more sensitive and responsive to growth (aka managed currency system). Establishing such an institution would allow for more aggressive measures to outgrow its colonized economy and foster industrialization.

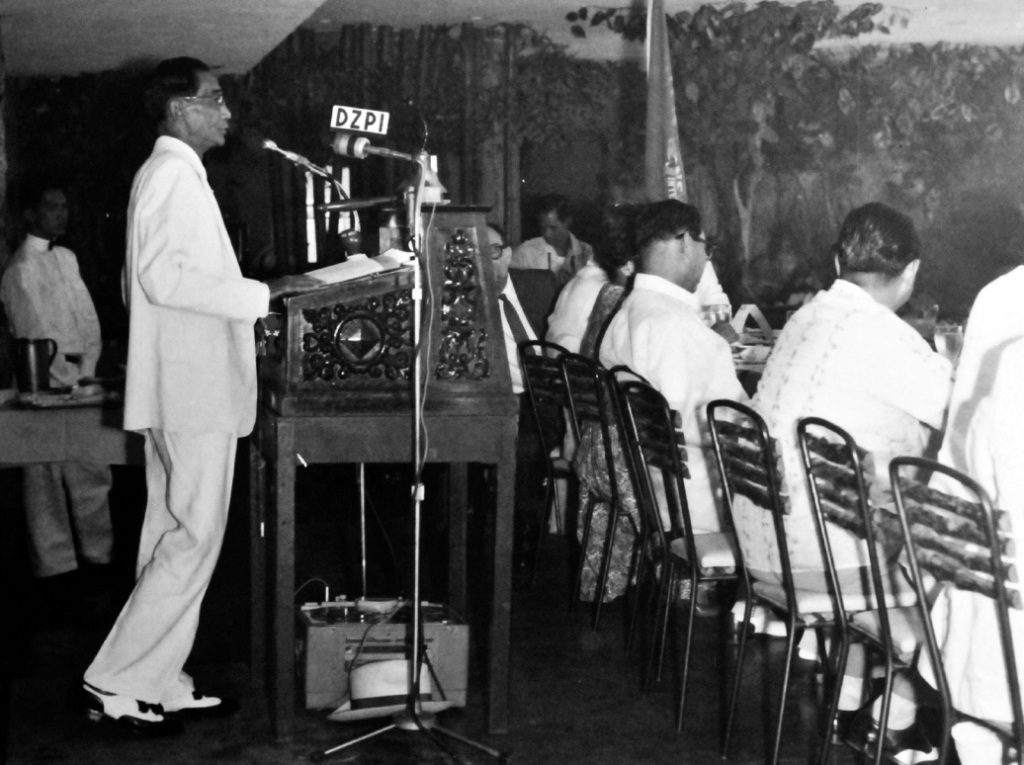

Cuaderno giving a speech (Bangko Sentral ng Pilipinas, 2024)

As the head of the Joint Philippine-American Finance Commission, Cuaderno was responsible for designing the Central Bank. He enjoyed a cooperative working relationship with key stakeholders gathering their support. During a presentation to the United States government, resistance was fierce, but he held his ground stating that the current system had failed. The power of the new Central Bank would allow for greater control of the circulation of currency, increase credit facilities, and stabilize foreign exchange. The Central Bank was not meant only as a sign of sovereignty but in the belief of Filipino competence in running the currency system.

Cuaderno arriving a a conference (Bangko Sentral ng Pilipinas, 2024)

Cuaderno’s design would lay the groundwork for the forming of the economic environment and there was finally control over the currency and its systems. Financial colonialism would finally be liquidated with the establishment of the Central Bank of the Philippines in 1949 and the Filipino people could face the future with certainty. The Philippines had much to learn and unlearn after centuries of colonization and from that have since developed a functioning economy with their newfound independence.

Me.

The idea came to me when I watched the famed musical, Hamilton – a renowned US founder who established the American monetary system. My curiosity got the better of me as I realized that we as a nation don’t celebrate the face of a great Filipino financial hero, let alone create a musical about him. May this article be the preface needed to uncover the heroes that made the stability of our nation.

To my readers, apologies for the delay in my writing as I had to focus on my level 3 CFA exam last August 2024. Given the accomplishment of the exam and more time to read leisurely, I hope this article will be a good reintroduction to my website and interests.